Epistemic status: mostly interesting as a tool to clarify your thinking about how tax rates should be decided. For a variety of practical reasons (especially these ones), we might want to have low marginal tax rates on the poor.

Suppose you’re trying to effectively tax a bunch of software engineers who are all making around $100k a year. Your current tax system charges 0% tax between $0k and $50k, then 50% after $50k.

This is very progressive. You consider changing it to the following regressive scheme: Charge 50% tax between $0k and $50k, then 0% after $50k.

Which tax is better, the regressive or the progressive tax?

–

The regressive tax is probably a Pareto improvement. It raises the same amount of revenue, but it’s less distortionary. A 60% marginal tax is going to discourage the engineers from working, and a 0% marginal tax won’t.

The key insight here is that when we’re taxing high-income people, we want to maximize average tax rates (for equitability) and minimize marginal tax rates (for efficiency). Because average tax rates come from the integral of marginal tax rates, you have to weigh between these two goals when you’re choosing tax systems.

–

What about if our society is pretty unequal? Let’s say it has two types of people, software engineers and musicians. Engineers make about $100k, musicians make about $40k. What’s the best redistributive system?

It’s going to be a regressive tax with a universal basic income. It turns out that it’s more important to have low marginal tax rates on engineers than musicians. As a utilitarian social planner, it’s much worse to discourage engineers from working than to discourage musicians from working, because if we want to increase the incomes of musicians, we can just give them free money as a UBI. So we want to put all the high marginal tax rates on the musicians, down at a low enough income level so that the engineers won’t be discouraged by them.

–

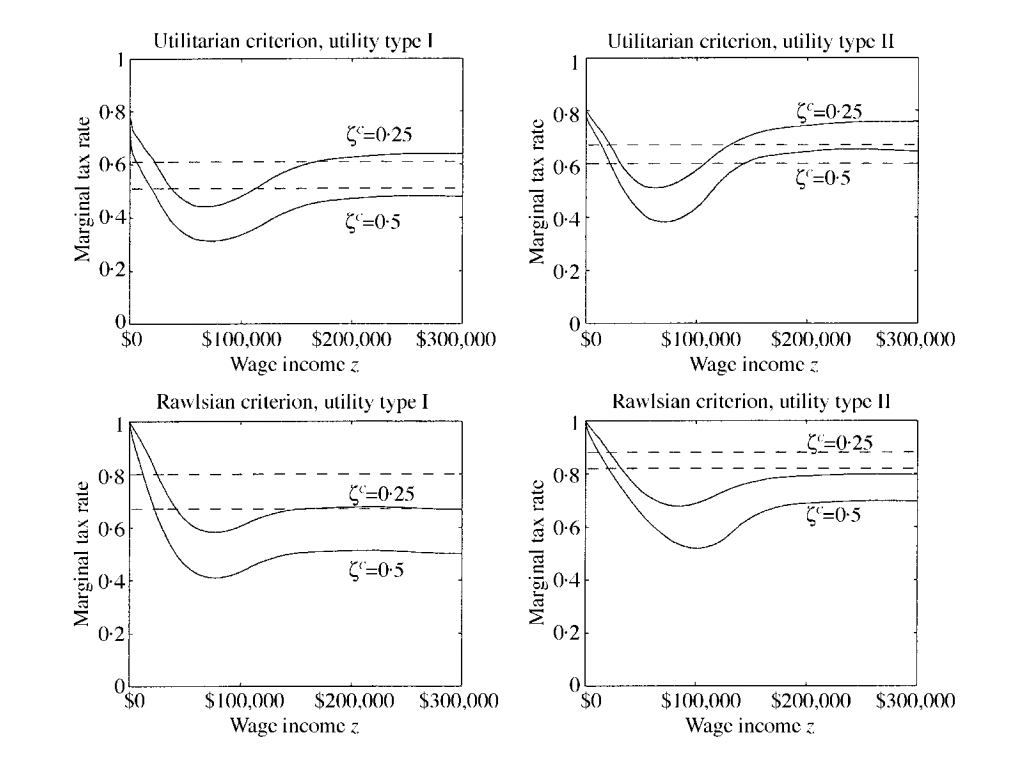

I’m not just making this up. Most economists seem to agree with me, including leftists like Emmanuel Saez—he’s a good friend of Piketty and a big supporter of increasing tax rates on the rich. His famous 2001 paper on deriving optimal marginal tax rates came up with these graphs which show a marginal tax rate of more than 60% for people making minimum wage:

And the more right-learning economists who wrote Optimal Taxation in Theory and Practice say

One perhaps counterintuitive result of these kinds of simulations is that they imply that marginal taxes should be higher at low wages than for most of the rest of the distribution. The intuition behind this result is that high marginal rates at low incomes allow for large lump-sum transfers to be given to those of the lowest ability levels without tempting higher-ability workers to work less and claim those transfers. For higher-ability workers, the net value of marginal income is too high at low incomes, so they are deterred from working less despite the generous redistribution offered to those with low ability.

So should we increase marginal tax rates on the poor? It turns out we don’t need to. We already have high marginal tax rates on the poor, because most welfare programs phase out their support as incomes increase. In the past, I’ve seen a bunch of people argue that this means-testing is bad, because of the extremely high marginal tax rates it imposes. But now that I’ve been convinced that high marginal tax rates on the poor are good, I’m not as concerned by this anymore.